Shareholder Stewardship

Oasis’s objective is to deliver strong absolute and risk-adjusted returns to our investors. We believe that public companies should manage their businesses in the best interests of shareholders at all times. For certain of our investment strategies, we seek to invest in high-quality, but undervalued and underperforming, public companies, and to work collaboratively with management teams and boards to execute operational and strategic initiatives designed to drive long-term sustainable earnings growth for the benefit of all shareholders. Oasis accepts its stewardship responsibilities and seeks to enhance the investment return for its investors by fostering and improving corporate value and the sustainable growth of its investee companies, through constructive engagement, purposeful dialogue, and in-depth knowledge of the companies and their business environments.

See below for information on country-specific stewardship codes to which we are signatories, and other information about how we exercise our stewardship responsibilities on a global basis.

Japan

Proxy Voting Records

See below at the links for the disclosure of aggregated information of Oasis’s proxy voting activity by market and issue/proposal category. Further detailed proxy voting records including voting records at the investee company meeting level are disclosed to Oasis’s clients and investors upon request.

Oasis is a proud member of the Japan Stewardship Initiative.

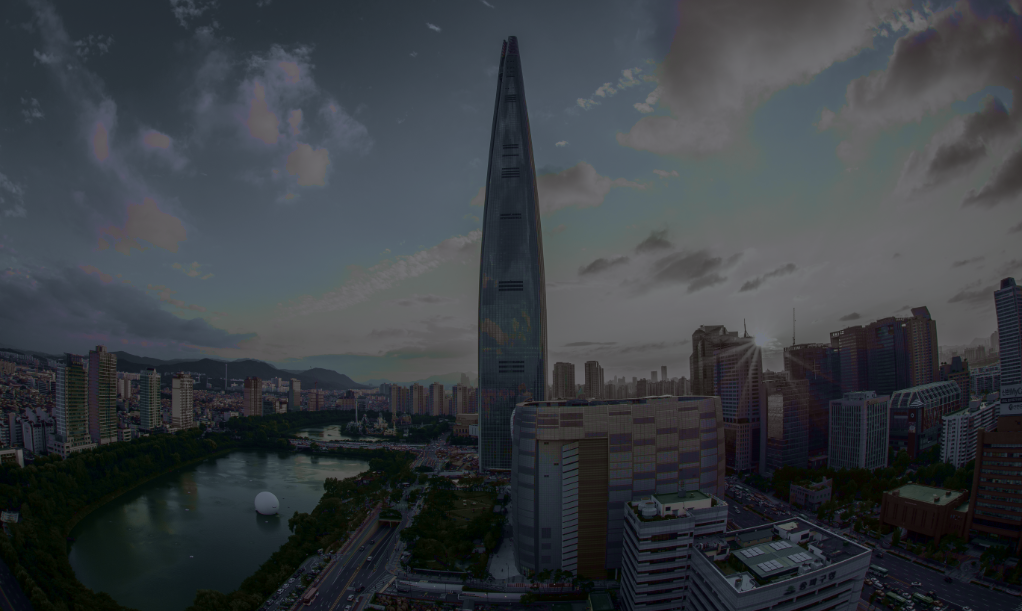

Oasis is a proud member of the Korean Corporate Governance Forum.